- Insight

- August 8, 2024

Plan Transition 5.0: Practical Guide to Funds for Italian Industry.

Introduction

The Transition 5.0 Plan, introduced by Article 38 of Decree-Law March 2, 2024, is an Italian government initiative aimed at supporting the transition of the national production system to more efficient and sustainable models.

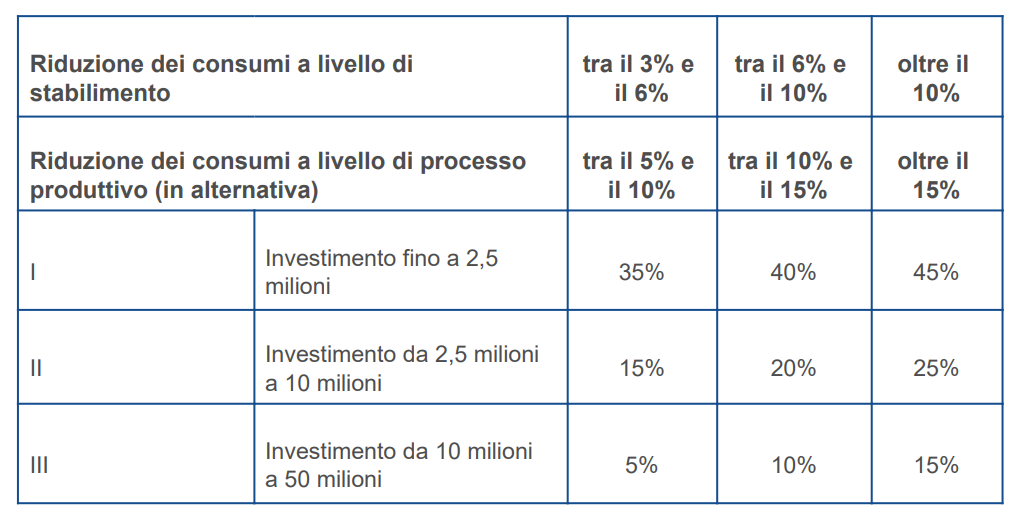

This plan offers businesses a tax credit scheme to promote investment in technological innovation and energy efficiency, with a subsidy of up to 45 percent of the investment.

Main Goals The Transition 5.0 Plan aims to achieve three main goals:

- Reduction of energy consumption of production facilities.

- Promotion of the use of renewable sources and sustainable education.

- Support for technological and sustainable innovation projects.

Subjects Beneficiaries

All companies resident in Italy are eligible for the tax credit, regardless of their legal form, economic sector, size and tax status.

Excluded are companies in bankruptcy, liquidation, arrangement without business continuity, or subject to bankruptcy proceedings, as well as those that do not comply with workplace safety regulations.

Eligible Projects

Innovation projects with the following characteristics are eligible:

- Timeline: started from January 1, 2024 and completed by December 31, 2025.

- Type of investment: one or more tangible and intangible assets in Annexes A and B ofIndustry 4.0.

- Energy saving: reduction of energy consumption of the production facility by at least 3 percent or of the processes affected by the investment by at least 5 percent.

Trailed investments may include:

- Self-Production of Energy: Investment in facilities for self-production of energy from renewable sources for self-consumption.

- Training: Training activities to acquire or consolidate skills in digital and energy transition technologies.

Ineligible Projects

- Activities related to the use of fossil fuels.

- Projects in the European Union Emissions Trading Scheme (ETS) that do not meet environmental benchmarks.

- Investments in waste landfills, incinerators, and mechanical biological treatment plants, with some specific exceptions

Methods of accessing credit

To take advantage of the tax credit, companies must obtain special certifications issued by an independent evaluator:

- Ex ante Certification: Initial assessment of the investment and attests to the reduction in energy consumption through the innovation project presented.

- Ex post certification: It certifies the realization of investments as stipulated in the ex ante certification and the resulting energy savings.

How can STEP support you?

The Transition 5.0 Plan represents a unique opportunity for Italian companies to improve energy efficiency, adopt sustainable solutions and innovate processes while obtaining substantial investment coverage.

STEP, as an Innovation Hub dedicated tosustainable innovation for Italian industry, together with its partner Europe Finance, supports you in implementing projects eligible for funding under the Transition 5.0 Plan.

What does our standard innovation project include?

- Implementable solutions in less than 5 months

- Guaranteed energy savings of 3% to 25%

- Payback time of less than 3 years

- Comprehensive support in the bureaucratic process for accessing credit

Request a consultation to find out how to STEP can help you make the most of the opportunities offered by the Transition 5.0 Plan.